Wire Transfer

If you wish to fund your account via wire transfer, please contact your account manager or access our live chat to receive the appropriate banking details.

Please note that there is a minimum deposit of €500 for wire transfers.

Your Internet Explorer browser is out of date. For better user experience, we suggest you to start using one of the following browsers: Google Chrome, Firefox Mozilla or Microsoft Edge.

This website (www.forextb.com/eu) is operated by Forex TB Limited, a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission with CIF licence number 272/15. Forex TB Limited is located at Lemesou Avenue 138, 2nd Floor, Office 108, 2015 Strovolos, Nicosia, Cyprus.

Forex TB Limited owns and operates the “ForexTB” brand.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82.75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance does not constitute a reliable indicator of future results. Future forecasts do not constitute a reliable indicator of future performance. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk tolerance. You should not deposit more than you are prepared to lose. Please ensure you fully understand the risk associated with the product envisaged and seek independent advice, if necessary. ForexTB does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of any financial product. Forex TB Limited is not a financial adviser and all services are provided on an execution only basis. Please read our Risk Disclosure document.

Forex TB Limited offers services within the European Economic Area (excluding Belgium) and Switzerland.

Forex TB Limited does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of any financial product. Forex TB Limited is not a financial adviser and all services are provided on an execution only basis.

Explore some of the most common terminology associated with trading CFDs available from ForexTB.

Record of all transactions.

Amount of money in an account.

A currency is said to appreciate when price rises in response to market demand; It’s stands for an increase in the value of an asset.

Taking advantage of countervailing prices in different markets by making a purchase or sale of an instrument, and simultaneously taking of an equal and opposite position in a related market to profit from the small price differentials.

The price, or rate, that a willing seller is prepared to sell at.

The Australian Dollar.

The departments and processes related to the settlement of financial transactions (i.e. written confirmation and settlement of trades, record keeping).

A record of all economic transactions between the residents of a country with the rest of the world in particular period of time. The balance of payments tracks international transactions, which include merchandise, services, and capital flows.

The value of a country’s exports minus its imports.

A technical analysis tool. The chart represents four significant points: the high and the low prices of a financial instrument, which forms the vertical bar, the opening price, which is marked with a little horizontal line to the left of the bar, and the closing price, which is marked with a little horizontal line of the right of the bar.

The currency in which an investor or issuer maintains its book of accounts; the currency that other currencies are quoted against. In the Forex market, the U.S. Dollar is normally considered the `base` currency for quotes, meaning that quotes are expressed as a unit of $1 USD per the other currency quoted in the pair.

One hundredth of a percent.

An investor who believes that prices and or the market will decline.

A market distinguished by a prolonged period of declining prices accompanied by widespread pessimism.

The price that a buyer is prepared to purchase at; the price offered for a currency.

Bonds are tradable instruments (debt securities) issued by a borrower to raise capital. They pay either fixed or floating interest, known as the coupon. As interest rates fall, bond prices rise and vice versa.

An individual, or firm, that acts as an intermediary, putting together buyers and sellers usually for a fee or commission. In contrast, a ‘dealer’ commits capital and takes one side of a position, hoping to earn a spread (profit) by closing out the position in a subsequent trade with another party.

The Deutsche Bundesbank is the central bank of the Federal Republic of Germany.

An investor who believes that prices and or the market will rise.

A market distinguished by a prolonged period of rising prices (Opposite of bear market).

A chart that indicates the trading range for the day as well as the opening and closing price. If the open price is higher than the close price, then the rectangle between the open and close price is shaded. If the close price is higher than the open price, that area of the chart is not shaded.

A government or quasi-governmental organisation that manages a country’s monetary policy a prints a nation’s currency. For example, the U.S. central bank is the Federal Reserve, others include the ECB, BOE, BOJ.

An individual who analyses charts, graphs and historical data to identify trends and predict future movements. Also referred to as Technical Trader.

The process of settling a trade.

Exposures in foreign currencies that no longer exist. The process to close a position is to sell or buy a certain amount of currency to offset an equal amount of the open position. In other words, it will ‘square’ the position.

A transaction fee charged by a broker.

A document exchanged by counterparts to a transaction that confirms the terms of said transaction.

The standard unit of trading.

The participant, either a bank or customer, with whom the financial transaction is made.

An exchange rate between two currencies. The cross rate is said to be non-standard in the country where the currency pair is quoted. For example: in the USA, a GBP/CHF quote would be considered a cross rate, whereas in the UK or Switzerland it would be one of the primary currency pairs traded.

Any form of money issued by a government or central bank.

The two currencies that make up a foreign exchange rate. For example: EUR/USD, GBP/JPY etc.

The risk of incurring losses resulting from an adverse change in exchange rates.

Opening and closing the same position or positions within the same trading session.

An individual or firm that acts as a principal or counterpart to a transaction. Principals take one side of a position, hoping to earn a spread (profit) by closing out the position in a subsequent trade with another party. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission.

A negative balance of trade or payments.

A transaction where both sides transfer possession of the currencies traded.

The borrowing and lending of cash. The rate that money is borrowed/lent at is known as the deposit rate (or depo rate). Certificates of Deposit (CDs) are also tradable instruments.

A decline in the value of a currency due to market forces.

A contract that changes in value in relation to the price movements of a related or underlying security, future or another physical instrument. An option is the most common derivative instrument.

The deliberate downward adjustment of a currency’s price, normally by official announcement.

The Central Bank for the European Monetary Union.

Traders account for their positions in two ways: accrual or mark-to-market. An accrual system accounts only for cash flows when they occur, hence, it only shows a profit or loss when realised. The mark-to-market method values the trader`s book at the end of each working day using the closing market rates or revaluation rates. Any profit or loss is booked and the trader will start the next day with a net position.

The currency of the European Monetary Union (EMU) which replaced the European Currency Unit (ECU).

The date on which a trade occurs.

The Central Bank for the United States.

An official exchange rate set by monetary authorities for one or more currencies. In practice, even fixed exchange rates fluctuate between definite upper and lower bands, leading to intervention.

To be neither long nor short is the same as to be flat or square. One would have a flat book if he has no positions or if all the positions cancel each other out.

The Federal Reserve monetary committee.

The simultaneous buying of one currency and selling of another in an over-the-counter market. Most major Forex is quoted against the U.S. Dollar.

The pre-specified exchange rate for a foreign exchange contract settling at some agreed future date, based upon the interest rate differential between the two currencies involved.

The pips added to or subtracted from the current exchange rate to calculate a forward price.

FRA are transactions that allow one to borrow or lend at a stated interest rate over a specific time period in the future.

The front office usually comprises of the trading room, and other main business activities.

Analysis of economic and political information with the objective of determining future movements in a financial market.

An obligation to exchange a good or instrument at a set price on a future date. The primary difference between a “future” and a “forward” is that futures are typically traded over an exchange (Exchange- Traded Contacts – ETC), versus forwards, which are considered Over The Counter (OTC) contracts. An OTC is any contract NOT traded on an exchange.

The five leading industrial countries, including USA, Germany, Japan, France and UK.

The seven leading industrial countries, including USA, Germany, Japan, France, UK, Canada and Italy.

Total value of a country’s output, income or expenditure produced within the country’s physical borders.

A gross domestic product plus income earned from investment or work abroad.

An order left with a dealer to buy or sell at a fixed price. The GTC will remain in place until executed or cancelled.

Making a position or combination of positions to reduce the risk of trader’s primary position.

Usually stands for the highest traded price and the lowest traded price of the underlying instrument during a trading day.

An economic condition where there is an increase in the price of consumer goods, thereby eroding purchasing power.

The initial deposit of collateral required to enter into a position as a guarantee on future performance.

The Foreign Exchange rates at which large international banks quote other large international banks.

Action by a central bank to influence the value of its currency by entering the market. Concerted intervention refers to action by a number of central banks to control exchange rates.

An exchange of two debt obligations when each of them have different payment streams. The transaction usually exchanges two parallel loans; one fixed and the other floating.

The New-Zealand Dollar.

Economic variables that are considered to predict future economic activity (i.e. Unemployment, Consumer Price Index, Producer Price Index, Retail Sales, Personal Income, Prime Rate, Discount Rate, and Federal Funds Rate).

Also called margin. The ratio between the amount used in a transaction to the required security deposit.

The London Inter-Bank Offered Rate. Large international banks use LIBOR when borrowing from another bank.

The closing of an existing position through the execution of an offsetting transaction.

The ability of a market to accept large transaction with minimal to no impact on price stability.

A position to purchase more of an instrument than is sold, hence, an appreciation in value if market prices increase.

A position that appreciates in value if market prices increase. When the base currency in the pair is bought, the position is said to be long.

The Canadian Dollar.

A unit to measure the amount of the deal. The value of the deal always corresponds to an integer number.

The required equity that an investor must deposit to collateralise a position.

A dealer who regularly quotes both bid and ask prices, and is ready to make a two-sided market for any financial instrument.

An order to buy/sell at the best price available when the order reaches the market.

A contingent order where the execution of one part of the order automatically cancels the other part.

An order that will be executed when a market moves to its designated price. Normally associated with GTC Orders.

An active trade with corresponding unrealised profit and loss, which has not been offset by an equal and opposite deal.

An agreement that allows the holder to have the option to buy/sell a specific security at a certain price within a certain time. There are two types of options: call option and put option. A call is the right to buy, while a put is the right to sell.

An order is an instruction, from a client to a broker to trade. An order can be placed at a specific price or at the market price. Also, it can be good until filled or until close of business.

A trade that remains open until the next business day.

The term used in currency market to represent the smallest incremental move an exchange rate can make. Depending on context, normally one basis point (0.0001 in the case of EUR/USD, GBD/USD, USD/CHF and 0.01 in the case of USD/JPY).

A position is a trading view expressed by buying or selling. It can refer to the amount of a currency owed by an investor.

In the currency markets, it is the amount of points added to the spot price to determine a forward or futures price.

The actual “realised” gain or loss resulting from trading activities on closed positions, plus the theoretical “unrealised” gain or loss on open positions that have been Mark-to-Market.

An indicative market price; shows the highest bid and/or lowest ask price available on a security at any given time.

A recovery in price after a period of decline.

The difference between the highest and lowest price of a future recorded during a given trading session.

The price of one currency in terms of another.

This type of trade involves the sale and later re-purchase of an instrument, at a specified time and date. Occurs in the short-term money market.

A term used in technical analysis indicating a specific price level at which a currency will have the inability to cross above. Recurring failure for the price to move above that point produces a pattern that can usually be shaped by a straight line.

To hedge one’s risk they will employ financial analysis and trading techniques.

A process in which the settlement of a deal is rolled forward to another value date. The cost of this process is based on the interest rate differential of the two currencies.

The process by which a trade is entered into the books and records of the counterparts to a transaction. The settlement of currency trades may or may not involve the actual physical exchange of one currency for another.

To go ‘short’ is to sell an instrument without actually owning it, and to hold a short position with expectations that the price will decline so it can be bought back in the future at a profit.

An investment position that benefits from a decline in market price. When the base currency in the pair is sold, the position is said to be short.

A transaction that occurs immediately, but the funds will usually change hands within two business days after deal is struck.

The current market price. Settlement of spot transactions usually occurs within two business days.

The difference between the bid and offer (ask) prices; used to measure market liquidity. Narrower spreads usually signify high liquidity.

An order to buy/sell at an agreed price. One could also have a pre-arranged stop order, whereby an open position is automatically liquidated when a specified price is reached or passed.

A technique used in technical analysis that indicates a specific price ceiling and floor at which a given exchange rate will automatically correct itself.

A currency swap is the simultaneous sale and purchase of the same amount of a given currency at a forward exchange rate.

An effort to forecast prices by analysing market data, i.e. historical price trends, averages, volumes, open interest, etc.

A minimum change in price, up or down.

Simultaneous buying and selling of a currency for delivery the following day.

Both the bid and ask rate is quoted for a Forex transaction.

The interest rate at which U.S. banks will lend to their prime corporate customers.

The date on which counterparts to a financial transaction agree to settle their respective obligations, i.e., exchanging payments. For spot currency transactions, the value date is normally two business days forward. Also known as maturity date.

A statistical measure of a market or a security’s price movements over time. It is calculated by using standard deviation. Associated with high volatility is a high degree of risk.

The number, or value, of securities traded during a specific period.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82.75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

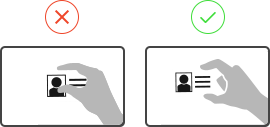

We need a few moments to check your documents. Please do not exit this window until we’ll finish. Thank you.

Most of our customers find it easier to upload these documents using their mobile phones.

• Please enter your mobile phone number and click on the “Send” button.

• A text message has been sent to your mobile phone.

• Please click on the link you have received on the text message.

• Now you can start uploading your documents.

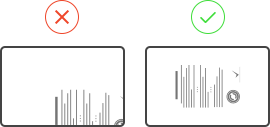

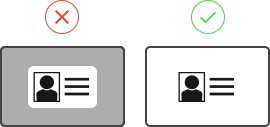

Do not obscure any part of the document

Do not obscure any part of the document

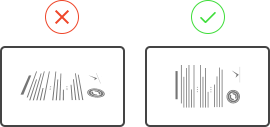

Do not obscure any part of the document

Do not obscure any part of the document

If you wish to fund your account via wire transfer, please contact your account manager or access our live chat to receive the appropriate banking details.

Please note that there is a minimum deposit of €500 for wire transfers.

With ForexTB you can fund your trading account via Perfect Money.

Use Perfect Money to deposit funds in your account in the currency** of your choice regardless of where you live in the world. Find out more details by clicking on the “Deposit” tab once you are logged in.

Once your Perfect Money account is funded, follow these steps to fund your ForexTB account:

Note – Please allow a few business hours for funds to be credited. Our business hours are 7:00am to 5:00pm GMT

*Conversion fees may be charged by Perfect Money or their vendor.

**Please make sure that you transfer funds from an account with the same denomination as your trading accounts.

In case of your transaction has been declined, you can get an instant help from our customer support.

Chat Now

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82.75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

You will be charged by ForexTB. This charge will appear on your statement as www.forextb.com +357 2 222 2353. Please feel free to contact us at +357 2 222 2353. This website is operated by Forex TB Ltd, registration number: HE310943 and registered at 45A Kratinou Street, 2040 Strovolos, Nicosia, Cyprus. The Company is regulated by CySEC, License Number: 272/15.

Don’t have an account? Sign up

Like all investment opportunities, trading Forex and CFD involves risk of loss. Here at ForexTB, we provide you with access to an education centre, risk-management tools and a customer support team.

Beware of individuals impersonating authority figures engaging in fraudulent activity. Stay informed by checking CySEC's official website for warnings and updates.

This section is open for clients only, please log in or sign up